The B2B money transfer market is very essential in the global business and trade liberalization processes. With the growth of international trade and increasing economic interconnectedness, the demand for efficient cross-border payment solutions has risen significantly. This blog post provides an understanding of the market segmentation, trends, challenges, and opportunities that exist in the B2B money transfer industry.

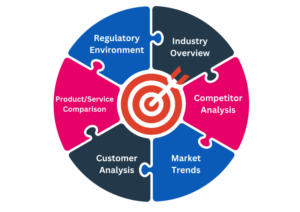

Comprehensive Market Analysis: A 360-Degree View

The B2B money transfer market is particularly diversified and has a large number of players influencing its activity. The market research provides a 360-degree analysis of historical and projected growth in terms of volume, value, production, and consumption.

The market is segmented by:

- Types of Transfers: Digital Transfers, Bank Wire, Blockchain-Based Transfers, Cross-Border Payments, and Real-Time Transfers.

- Applications: International Trade, Vendor Payments, E-Commerce, and Supply Chain Finance

Some of the specific areas of interest are North America and APAC regions where the company currently enjoys a great market. Further, it is expected to grow faster. This segmentation helps businesses identify growth opportunities and develop targeted strategies to maximize market share.

Competitive Landscape and Strategic Developments

Activities of the major industry players are shaping the competitive landscape of the B2B remittance market. The report highlights:

- Product Portfolios: Companies’ offerings in digital and traditional remittance solutions.

- Key Developments: Mergers, acquisitions, and collaborations.

- Strategic Expansion: Initiatives to increase market penetration and enhance service offerings.

For example, partnerships between fintech companies, banks, and remittance providers are creating innovative solutions. Such collaborations will lead to enhanced customer experiences and will lead to the market growth.

Key Trends Shaping the Market

No doubt that the B2B remittance market is experiencing transformative trends that are reshaping its landscape. Some key trends include:

Collaborations for Market Expansion

Industry collaborations between banks and fintech companies are opening up new horizons to enter this market. These collaborations integrate the strengths of both the companies’ resources to develop unique solutions. In this way, using these alliances, firms can achieve growth and the development of the customer base as well as the diversification of services that companies provide can help them stay relevant.

Regulatory Evolution and Innovation

The governments and the regulatory authorities continue to apply the existing frameworks for dealing with the emerging risks and fostering innovations during the money transfer. Key measures include:

- Regulatory Sandboxes: Providing a controlled environment for testing new financial products and services.

- Consumer Protection Initiatives: Transparency and security provisions for digital remittances.

- Licensing and Compliance Standards: Providing financial access and still ensuring the financial system is not compromised.

Challenges in the Digital Remittance Market

Despite having great potential, there are specific challenges that the digital remittance market faces:

Complex Regulatory Environment

There are a lot of rules and regulations that are in force and this forms a major challenge. This means that the flow of operations across the countries cannot be easily synchronized due to variation in the financial regulations. Rules of Anti Money-Laundering and Know Your Customer policy pertain to strong identification and checks on transactions. No matter that these measures are absolutely necessary, it ultimately increases the operational costs and also complexity.

Also Read : Introduction to Stock Market Investing for Beginners

Operational Costs and Policy Changes

Compliance mechanisms no doubt are resource-intensive. Furthermore, shifts in either or both the regulatory policies or rules can add another level of difficulty and cost, to the budgets, affecting the smaller players in the industry mainly.

Future Opportunities in the Market

The B2B money transfer market has great potential for growth, driven by technological advancements and changing consumer demands:

Blockchain and Real-Time Transfers

Blockchain technology continues to attract attention as a reliable, complete, and rapid method of executing cross-border payments. Moreover, real-time transfer systems are also now common for managing those business activities and for reducing transaction time.

![]()

Financial Inclusion Initiatives

Initiatives promoting the improvement of the accessibility of financial services with a focus on some of the most distant parts of the world are opening new prospects for digital remittance players. By identifying the barriers to access costs and connectivity, companies can expand or penetrate to the new markets thereby increasing the economic growth.

Final Thoughts

The B2B money transfer industry is at a turning point now and adapting to the shifts in trends, regulations, and customers. Businesses must be able to respond proactively to challenges by using strategic partnerships, information technology, and key initiatives to help create value and to capitalize on value-generating opportunities.

As the market is evolving, those players that are able to manage regulatory environment changes, embrace partnerships and tend to focus on the customer value proposition can become the key market players in this competitive environment. The future of the B2B remittance market is one of innovation, inclusivity, and global integration.